In the world of trading, having the right tools can make a significant difference. One such tool that has gained immense popularity among traders is TradingView. Renowned for its comprehensive charting capabilities and community-driven approach, TradingView offers a plethora of indicators to aid in market analysis. However, for those looking to tailor their trading strategy to their unique needs, custom TradingView indicators provide an invaluable edge.

Custom TradingView indicators allow traders to create bespoke technical indicators that suit their specific trading style and requirements. Unlike standard indicators, which are pre-built and may not cater to the nuances of every trading strategy, custom indicators can be programmed to analyze particular market conditions, filter signals, and execute strategies more precisely.

The process of creating custom TradingView indicators typically involves the use of Pine Script, TradingViewÕs native programming language. Pine Script is designed to be user-friendly, even for those with minimal programming experience. It enables traders to write and backtest their own indicators and strategies within the TradingView platform.

HereÕs a brief overview of how to get started with custom TradingView indicators:

Understanding Pine Script: Before diving into creating custom indicators, itÕs crucial to get a basic understanding of Pine Script. TradingView provides a comprehensive Pine Script manual and a supportive community where beginners can learn and ask questions.

Defining Your Strategy: Clearly define what you want your custom indicator to accomplish. Whether itÕs identifying specific price patterns, calculating complex mathematical formulas, or integrating multiple data sources, having a clear goal will guide your scripting process.

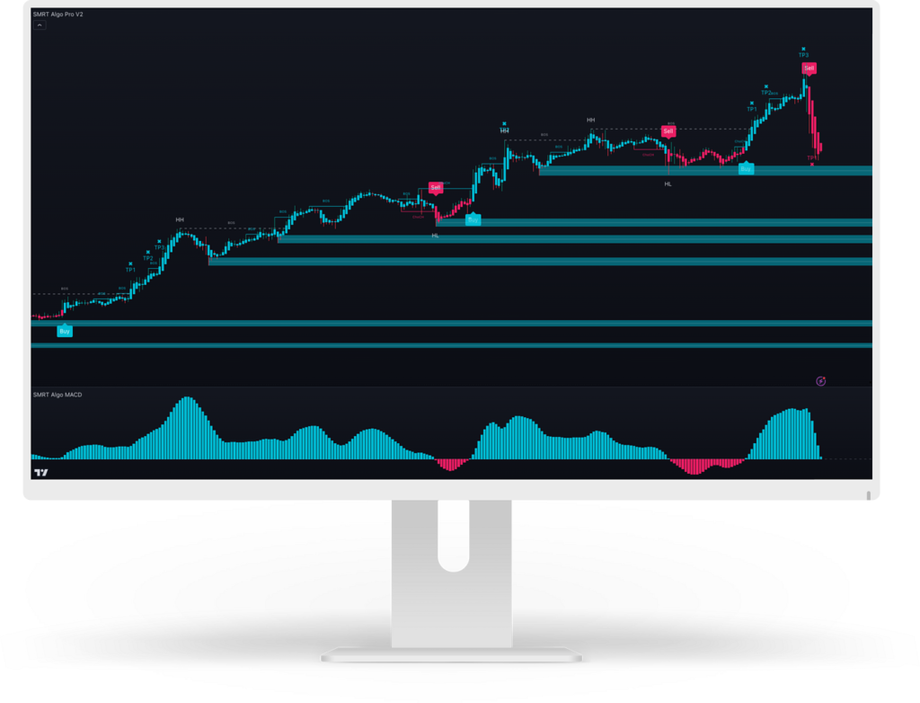

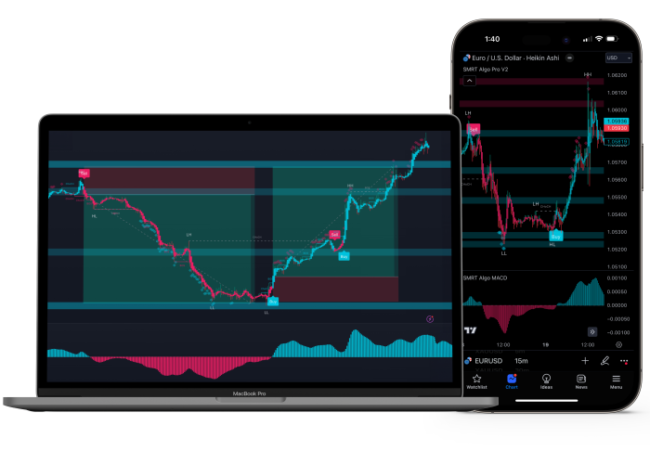

Writing the Script: Using Pine Script, start coding your indicator. TradingViewÕs editor offers syntax highlighting and debugging tools to streamline this process. For instance, you can write a script to create a custom moving average crossover indicator that signals potential buy and sell points.

Backtesting and Optimization: Once your script is complete, backtest it against historical data to see how it performs. This step is crucial to ensure your indicator provides reliable signals. Adjust and optimize the parameters as needed based on the backtest results.

Implementation and Monitoring: After successful backtesting, implement your custom indicator on live charts. Monitor its performance and make adjustments as market conditions evolve.

Using TradingView indicators, whether standard or custom, can significantly enhance your trading decisions. Custom indicators, in particular, offer the flexibility to adapt to ever-changing market dynamics, providing a personalized approach to trading that can lead to more effective and profitable strategies.

In conclusion, custom TradingView indicators are a powerful tool for any trader looking to gain a competitive edge. By leveraging Pine Script to create tailored indicators, traders can refine their strategies, improve signal accuracy, and ultimately, achieve better trading outcomes.

For more info :-