In the ever-evolving landscape of digital finance, the singularsingular wallet emerges as a beacon of innovation and convenience. As the world transitions towards decentralized ecosystems, the need for efficient and secure means of managing digital assets becomes paramount. With Singular Wallet, users are empowered to navigate this new frontier with confidence and ease.

Streamlining Asset Management

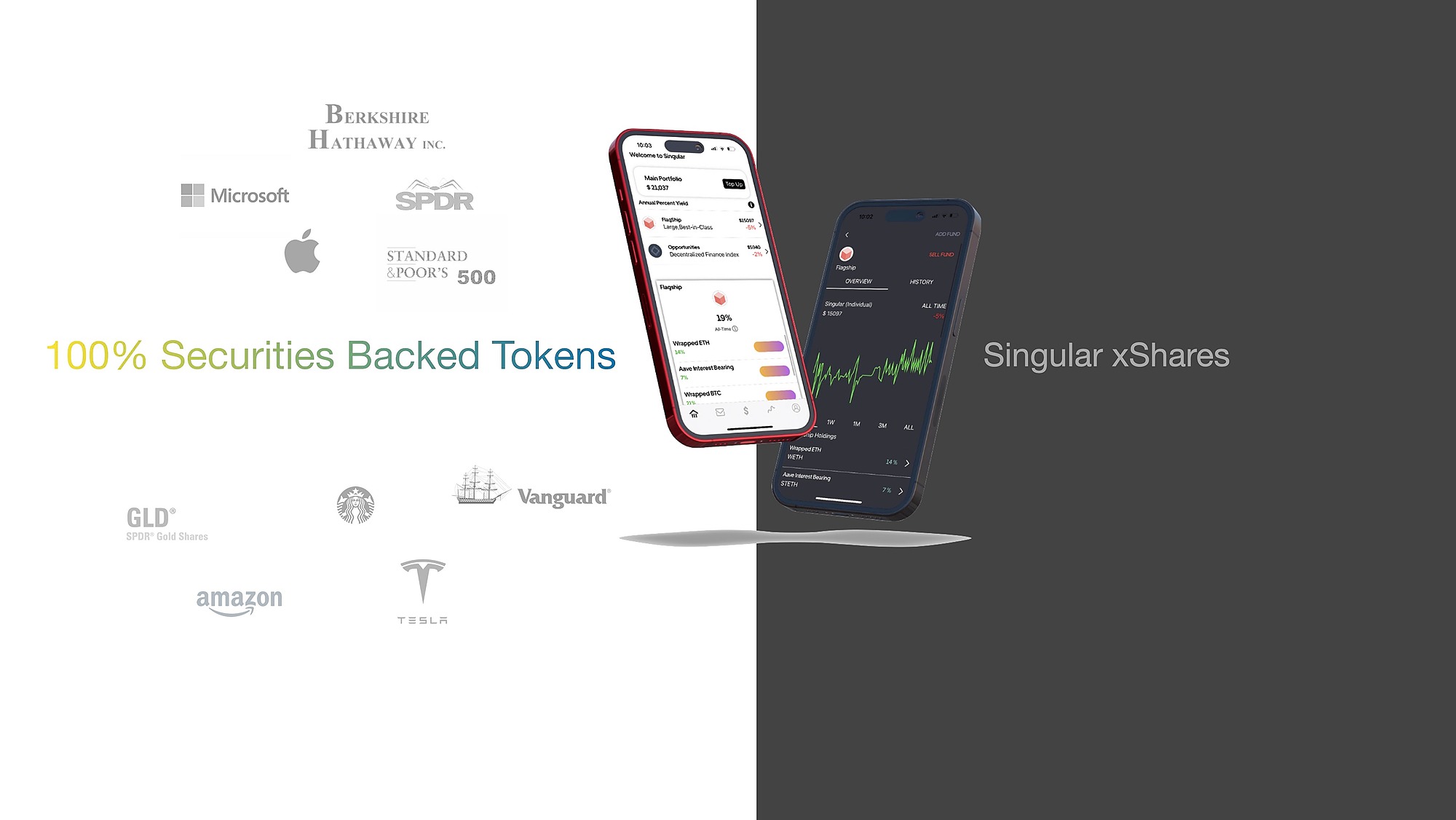

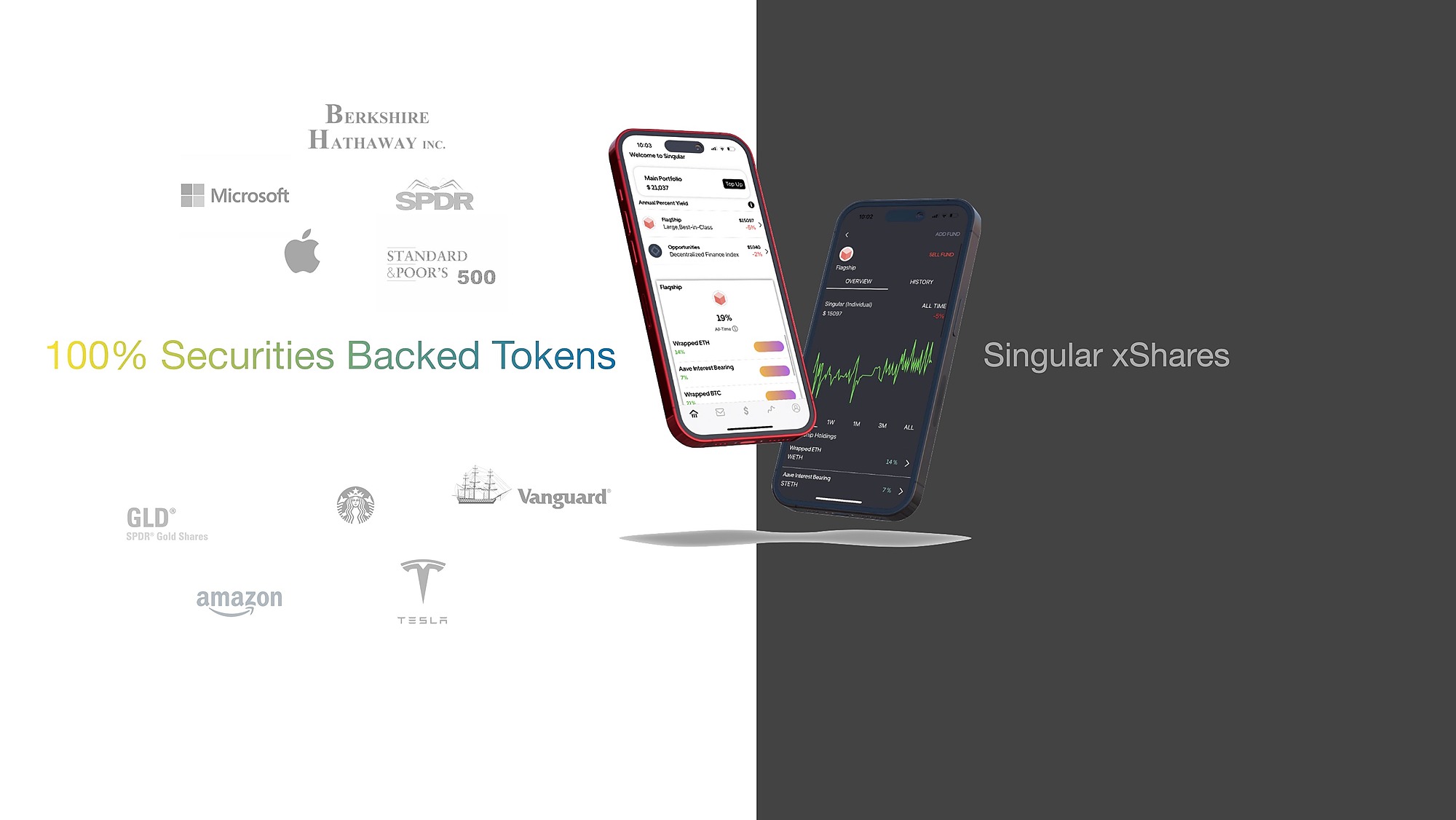

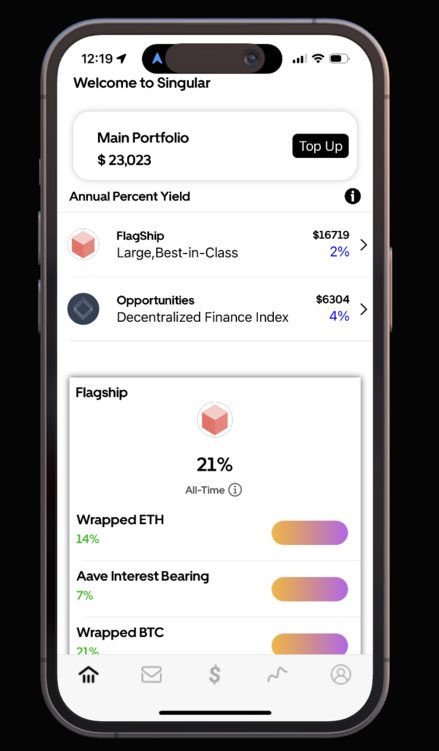

It might be difficult to manage a varied portfolio of digital assets. From cryptocurrencies to decentralized finance (DeFi) tokens, the array of investment opportunities can overwhelm even the most seasoned investor. This is where Singular Wallet steps in, offering a singular solution for all your asset management needs.

Seamless Integration of Singular Coin

At the heart of the Singular Wallet ecosystem lies the Singular Coin, a versatile digital asset designed to streamline transactions and optimize investment strategies. With its seamless integration into the Singular Wallet platform, users can enjoy unparalleled flexibility and efficiency in managing their digital wealth. Whether you're trading, staking, or simply holding, Singular Coin paves the way for a frictionless experience.

Empowering Financial Freedom

In today's fast-paced world, financial freedom is more than just a lofty aspirationÑit's a fundamental human right. With Singular Wallet, individuals gain unprecedented control over their financial destiny. By harnessing the power of blockchain technology, Singular Wallet empowers users to transcend geographical boundaries and traditional financial limitations.

A Global Network of Expertise

Behind the scenes, Singular operates as a globally distributed team of industry-leading experts. From data scientists to software engineers, their diverse skill sets converge to create a seamless user experience. Whether you're a seasoned investor or a newcomer to the world of digital finance, Singular's team is dedicated to guiding you every step of the way.

Optimizing Risk-Adjusted Returns

In the realm of digital asset management, optimizing returns while minimizing risks is paramount. Singular achieves this delicate balance through actively rebalanced multi-strategy funds. By leveraging advanced methodologies and cutting-edge technology, Singular ensures that your investments work smarter, not harder.

Empowering Users with Singular Crypto

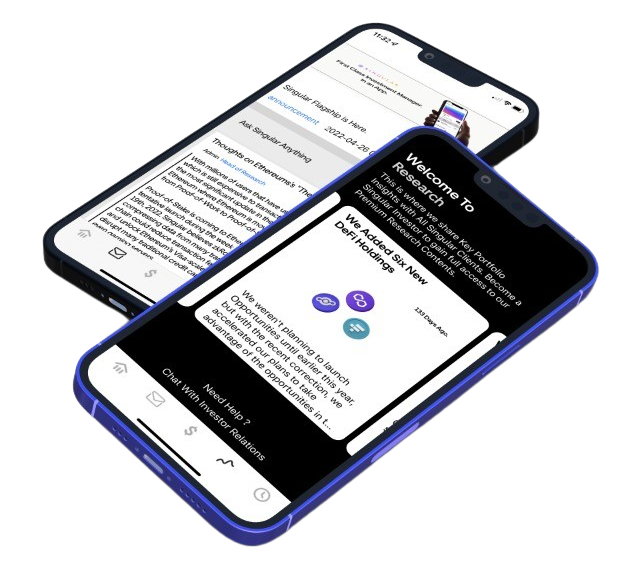

Singular Wallet isn't just another crypto wallet; it's a gateway to the future of finance. By leveraging advanced encryption techniques and decentralized protocols, Singular Wallet ensures that your digital assets are always safe and accessible. Whether you're a seasoned trader or just dipping your toes into the world of cryptocurrency, Singular Wallet provides the tools and resources you need to navigate this exciting new frontier with confidence.

Conclusion:

The future of finance is here, and it's powered by Singular. With its innovative approach to asset management and unwavering commitment to user empowerment, Singular Wallet stands at the forefront of the digital revolution. To experience the next generation of financial freedom, visit Singulardex.com today and unlock a world of possibilities.

Blog Source URL :

https://singulardex.blogspot.com/2024/04/unlocking-future-of-finance-with_23.html