The rise of cryptocurrencies has introduced new paradigms in trading and asset management, with decentralized exchanges (DEX) and secure storage solutions like the Singular Wallet at the forefront of this evolution. This article delves into the benefits and functionalities of decentralized trading platforms and the Singular Wallet, highlighting their roles in enhancing the security and efficiency of digital asset management.

Decentralized Trading: The Evolution of Crypto Exchanges

Decentralized exchanges (DEX) represent a significant shift from traditional, centralized trading platforms. By leveraging blockchain technology, DEX platforms facilitate peer-to-peer trading without the need for intermediaries, offering a range of advantages over their centralized counterparts.

Key Features of DEX:

- Enhanced Security: DEX platforms operate on decentralized networks, reducing the risk of hacks and security breaches common in centralized exchanges. Users retain control over their private keys and funds, which are not held in a central repository vulnerable to attacks.

- Privacy and Anonymity: Unlike centralized exchanges that require users to complete Know Your Customer (KYC) procedures, many DEX platforms offer enhanced privacy. Users can trade directly from their wallets without disclosing personal information, preserving anonymity.

- Reduced Counterparty Risk: DEX platforms eliminate counterparty risk by enabling direct trades between users. Smart contracts facilitate transactions, ensuring that trades are executed according to predefined rules without relying on a central authority.

- Global Accessibility: DEX platforms are accessible to users worldwide, offering trading opportunities without geographic restrictions. This inclusivity allows traders from regions with limited access to centralized exchanges to participate in the global crypto market.

- Increased Control and Flexibility: Traders have full control over their assets and trading strategies on DEX platforms. They can engage in various trading activities, including swapping tokens, providing liquidity, and participating in decentralized finance (DeFi) protocols.

Singular Wallet: Advanced Security for Digital Assets

The Singular Wallet is designed to complement decentralized trading by offering a secure and user-friendly solution for managing digital assets. With a focus on security, accessibility, and versatility, the Singular Wallet enhances the overall user experience in the cryptocurrency ecosystem.

Core Features of Singular Wallet:

- Robust Security: Singular Wallet prioritizes security with advanced encryption and multi-signature authentication. Users' private keys are securely stored, and transactions require multiple approvals, minimizing the risk of unauthorized access and fraud.

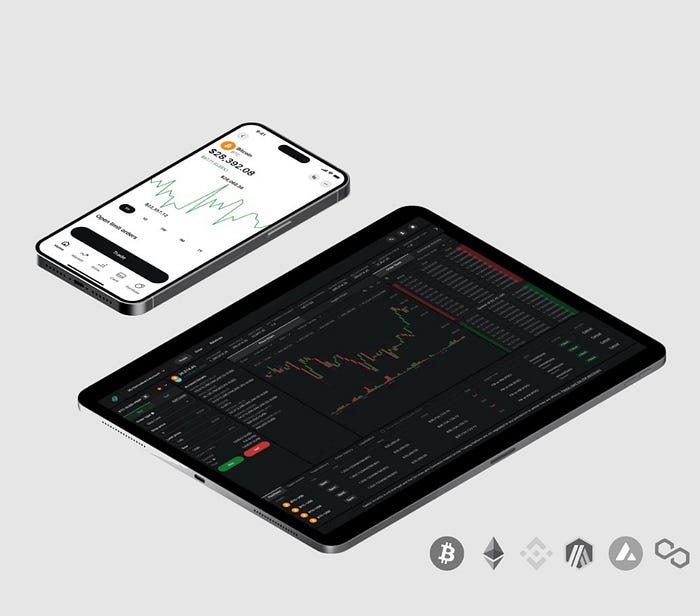

- Cross-Platform Compatibility: The wallet supports various devices, including desktops, tablets, and mobile phones. This cross-platform compatibility ensures users can access and manage their assets seamlessly, whether they are at home or on the go.

- Integrated Trading and Management: Singular Wallet integrates with decentralized exchanges, allowing users to trade directly from the wallet. This feature streamlines the trading process, enabling users to manage their assets and execute trades without leaving the wallet interface.

- Real-Time Market Data: The wallet provides real-time market data and analytics, helping users make informed trading decisions. Features like price alerts and portfolio tracking enable users to stay updated on market trends and optimize their investment strategies.

- User-Friendly Interface: Singular Wallet is designed with a focus on user experience. Its intuitive interface simplifies the process of managing digital assets, making it accessible to both novice and experienced users.

The Synergy of DEX and Singular Wallet

The combination of decentralized exchanges and the Singular Wallet offers a comprehensive solution for secure and efficient digital asset management. HereÕs how they work together to enhance the user experience:

- Seamless Integration: Singular Wallet's integration with DEX platforms allows users to trade directly from their wallets, providing a streamlined experience. Users can access a wide range of trading pairs and liquidity options without needing to transfer assets between different platforms.

- Enhanced Security: By using Singular Wallet for trading on DEX platforms, users benefit from the enhanced security features of both the wallet and the exchange. The combination of decentralized trading and secure wallet storage mitigates risks associated with centralization and unauthorized access.

- Efficient Asset Management: The walletÕs real-time market data and analytics tools complement the trading capabilities of DEX platforms. Users can monitor market conditions, execute trades, and manage their portfolios efficiently within a single interface.

- Greater Control and Privacy: The decentralized nature of DEX platforms, combined with the privacy features of Singular Wallet, provides users with greater control over their trading activities and personal information. This combination aligns with the broader goals of decentralization and user empowerment in the crypto space.

Conclusion

The evolution of decentralized trading and secure storage solutions like Singular Wallet represents a significant advancement in the cryptocurrency market. By offering enhanced security, privacy, and control, DEX platforms and Singular Wallet are reshaping how users interact with digital assets. As the crypto landscape continues to evolve, these innovations pave the way for a more secure, efficient, and user-centric approach to digital finance. Embracing these technologies enables users to navigate the complexities of the crypto world with greater confidence and ease.

Blog Source URL:

https://singulardex.blogspot.com/2024/11/decentralized-trading-and-secure.html