As technology progresses, so does the ease with which we can manage our daily tasks, including how we pay electricity in South Africa. This process has evolved from traditional in-person payments at local utility offices to convenient online platforms that allow users to manage their accounts remotely. This shift not only saves time but also enhances the accuracy of transactions, ensuring that users can keep their lights on without the hassle of waiting in long queues or dealing with bureaucratic inefficiencies.

Harnessing Mobile Technology to Pay Electricity in Kenya

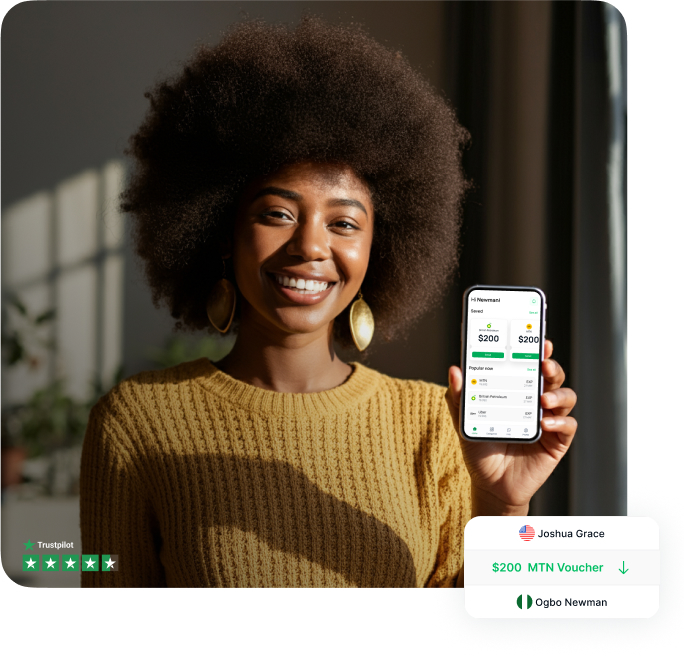

In Kenya, mobile technology has revolutionized many aspects of daily life, including how people Pay electricity Kenya. Mobile payment solutions have become a popular choice due to their accessibility and ease of use, allowing millions of users to manage their utility bills directly from their smartphones. This has been particularly transformative in rural areas, where traditional banking services are scarce but mobile coverage is extensive. By leveraging mobile platforms, Kenyans can ensure timely payments, avoid disconnections, and enjoy a consistent electricity supply.

Impact of Reliable Electricity Payment Systems

Reliable electricity payment systems are crucial for economic stability in both urban and rural communities. By providing a dependable way to pay for electricity in South Africa and Kenya, these systems support small businesses, educational institutions, and healthcare facilities in managing their energy expenses effectively. This reliability encourages consistent service delivery and contributes to overall economic growth, proving that efficient payment systems are more than just a convenienceÑthey are a cornerstone of sustainable development.

Boosting Financial Inclusion Through Electricity Payments

The integration of mobile payment technologies in the utility sector has played a significant role in boosting financial inclusion. In regions where traditional banking is limited, the ability to pay for electricity in Kenya via mobile platforms opens up opportunities for millions to engage with the formal financial system. This access is not only about paying bills but also about fostering a culture of financial awareness and planning, which can lead to improved savings and investment habits among the population.

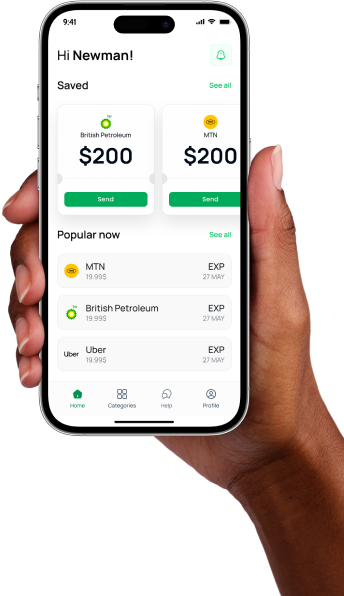

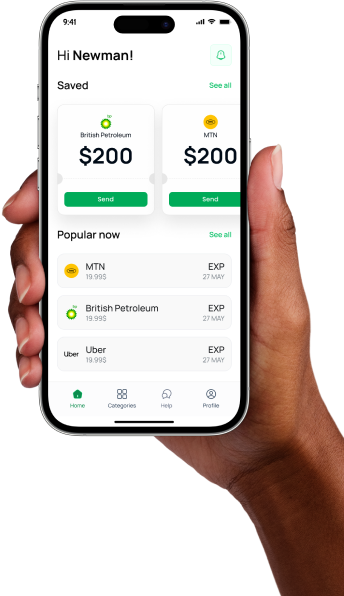

Innovations in Payment Technologies

The ongoing innovations in payment technologies continue to reshape how consumers interact with utility services. New developments in blockchain and digital payment solutions offer even greater transparency and security, reducing the risk of fraud and enhancing consumer confidence. As these technologies become more mainstream, they promise to make the process of paying for electricity in South Africa even more streamlined and user-friendly, setting a standard for other regions to follow.

The Future of Utility Payments in Africa

Looking forward, the future of utility payments in Africa appears bright, with continued advancements in technology paving the way for even more efficient and reliable systems. As more countries adopt digital solutions, the continent could see a significant reduction in energy payment delinquencies and an increase in overall utility service satisfaction. This progress is crucial for AfricaÕs continued economic development and the well-being of its citizens.

Conclusion

Managing utility payments efficiently is vital for both personal convenience and economic development. With platforms like lipaworld.com, paying for utilities such as electricity has become more accessible, secure, and reliable than ever before. Whether in South Africa or Kenya, Lipa World offers innovative solutions that cater to the unique needs of each market, ensuring that every transaction is as smooth as possible. This commitment to service excellence makes Lipa World an essential partner in the journey towards modernized and efficient utility payment systems across Africa.

Blog Source URL :- https://lipaworld.blogspot.com/2024/12/streamlining-utility-payments-across.html