- To turn your Foreign Exchange or CFD trading into a profitable business, you must follow the appropriate procedures and protocols. Trading has become considerably faster and much more profitable than ever before, thanks to modern technical breakthroughs that are now available to everyone. Traders & brokers have used specific software & trading systems to increase their prospective profits. Although there is no certainty in achieving large profits without the need for a correct market analysis, it is still feasible to reduce this risk by using the services of MetaTrader Forex brokers.

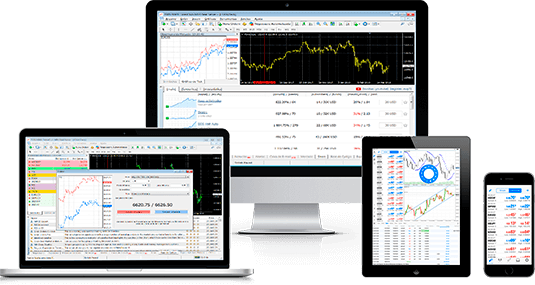

MetaTrader is one of the most well-known trading platforms for foreign exchange. Whenever we discuss about platforms in this marketplace, we mean the application or software that allows you to track the existing markets or open and close transactions within your Forex broker's account. MetaTrader is available to both novice and expert traders who want to increase their profits while performing other crucial duties.

Because of its fast speed and capacity to provide trustworthy integrated Forex market information, several brokers have backed the services of this Precious Metals CFD TradingSome Forex brokers even provide free trial or demo accounts to users who want to test an automated forex trading system on this platform. It also helps new traders to hone or refine their skills before engaging in live trading.

MetaTrader forex brokers additionally provide a platform that contains currency trend charts as well as a variety of tools for technical analysis and Metatrader 5 Signals. Moving averages, oscillators, and other indicators are all included in a single application. These, in return, provide up-to-date information & real-time trend changes to aid your market reading.

Reasonable Metatrader 5 Cost additionally supports the MQL programming language, which allows traders to customise their charts, write scripts, & build custom indicators. The integration can also be used to place fresh orders utilising this platform, which has resulted in the development of automated trading. These automatic robots are termed as Expert Advisers, and they can be utilised to analyse data or execute critical tasks on your system. They even contain email and diary tools, as well as the opportunity to automate the complete trading process.

Extra MQL modules can also be installed.

MetaTrader forex firms also record a history of prices that may be downloaded using the platform. You can use this list to evaluate your trading techniques or to run your robots to see how much money you will make.

Choose a MetaTrader broker that fits your Gold CFD Trading style before selecting one. Despite the reality that they all utilize the same trading software, not all foreign exchange MetaTrader traders are the same. A few will offer various account setups in respect of swap rates, spreads, or minimum lot sizes, which may not be suitable for your trading choices.

There is an abundance of Forex brokers, and the most efficient and straightforward approach to find one is to look online for a reliable one. If you use a broker in conjunction with the trading system, the broker would monitor the trading system on your behalf.

MATHE

VANUATU